Customer Acquisition Cost, often referred to as CAC, is a critical metric in the realm of business operations. Understanding how to calculate and optimize this cost can make or break a company’s success. Let’s dive into the world of CAC and explore its significance across different industries.

Customer Acquisition Cost Overview

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. This includes all marketing and sales expenses associated with attracting a customer to make a purchase.

Understanding and calculating CAC is essential for businesses to ensure they are spending their resources effectively and efficiently. By knowing how much it costs to acquire a customer, businesses can determine the return on investment for their marketing and sales efforts.

Calculating CAC in Different Industries

In the SaaS (Software as a Service) industry, CAC is calculated by dividing the total sales and marketing expenses by the number of new customers acquired within a specific period. For example, if a company spent $10,000 on marketing and acquired 100 customers, the CAC would be $100.

In the e-commerce industry, CAC can be calculated by dividing the total marketing and advertising expenses by the number of customers gained through those efforts. For instance, if an online retailer spent $5,000 on ads and acquired 50 customers, the CAC would be $100.

In the telecommunication industry, CAC may involve considering the costs of customer acquisition channels such as online ads, referrals, and direct sales efforts. By analyzing the effectiveness of each channel in bringing in new customers, companies can optimize their strategies to reduce CAC and increase profitability.

Factors Influencing Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), there are several key factors that can influence how much a business spends to acquire a new customer. Understanding these factors is crucial for optimizing marketing strategies and maximizing ROI.

Marketing strategies play a significant role in determining CAC. By choosing the right channels, targeting the right audience, and optimizing campaigns, businesses can effectively lower their CAC and improve cost-efficiency.

Quality of Leads

The quality of leads generated through marketing efforts can greatly impact CAC. Higher quality leads are more likely to convert into customers, resulting in a lower CAC. By focusing on lead nurturing and targeting qualified leads, businesses can improve the quality of their customer acquisition efforts.

Conversion Rates

The conversion rates at each stage of the customer journey can also influence CAC. By improving conversion rates through targeted messaging, personalized content, and optimized landing pages, businesses can reduce the overall cost of acquiring new customers.

Retention Strategies

Implementing effective retention strategies can help lower CAC by increasing customer lifetime value. By engaging with existing customers, providing excellent customer service, and offering loyalty programs, businesses can retain customers longer and reduce the need to constantly acquire new ones.

Referral Programs

Encouraging existing customers to refer new customers can be a cost-effective way to acquire new business. By implementing referral programs and incentivizing customers to spread the word, businesses can lower their CAC while leveraging the power of word-of-mouth marketing.

Example: Content Marketing

Content marketing is a successful strategy that has been proven to lower CAC for many businesses. By creating valuable, relevant content that attracts and engages target audiences, businesses can generate leads at a lower cost compared to traditional advertising methods. This not only reduces CAC but also helps build brand awareness and credibility in the long run.

Calculating Customer Acquisition Cost

Calculating Customer Acquisition Cost (CAC) is essential for businesses to understand how much they are spending to acquire new customers. By accurately tracking expenses related to customer acquisition, businesses can make informed decisions to improve their marketing strategies and maximize their return on investment.

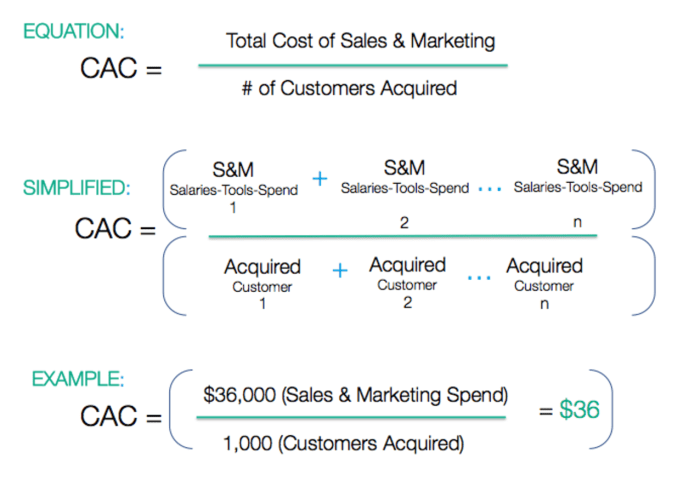

The Formula for Calculating CAC

Calculating CAC involves dividing the total costs associated with acquiring customers by the number of customers acquired within a specific time frame. The formula for CAC is:

CAC = Total Sales & Marketing Expenses / Number of Customers Acquired

Importance of Accurately Tracking Expenses

Accurately tracking expenses related to customer acquisition is crucial for businesses to determine the effectiveness of their marketing campaigns and allocate resources efficiently. It helps businesses identify areas where they can reduce costs and optimize their strategies to acquire customers at a lower cost.

Step-by-Step Guide on How to Calculate CAC for a Business

- Identify all sales and marketing expenses incurred within a specific period.

- Calculate the total sum of these expenses.

- Count the number of customers acquired during the same period.

- Divide the total sales and marketing expenses by the number of customers acquired to get the Customer Acquisition Cost.

- Regularly review and update the CAC calculation to track changes and make necessary adjustments to marketing strategies.

Improving Customer Acquisition Cost Efficiency

When it comes to reducing Customer Acquisition Cost (CAC) while still attracting and retaining customers, businesses need to implement strategies that optimize their marketing efforts. By focusing on maximizing customer lifetime value (CLV) and making efficient use of resources, companies can improve their CAC efficiency.

Utilize Targeted Marketing Campaigns, Customer Acquisition Cost

One effective strategy to reduce CAC is to create targeted marketing campaigns that reach the right audience. By analyzing customer data and behavior, businesses can tailor their messages to specific segments, increasing the likelihood of conversion.

Enhance Customer Retention Programs

Improving customer retention rates can significantly impact CAC efficiency. By providing exceptional customer service, personalized experiences, and loyalty programs, businesses can keep existing customers engaged and loyal, reducing the need for constant acquisition efforts.

Invest in Referral Programs

Referral programs have proven to be a cost-effective way to acquire new customers. By incentivizing current customers to refer friends and family, businesses can tap into a network of potential leads that are more likely to convert, thereby reducing CAC.

Focus on Customer Experience

Providing a seamless and enjoyable customer experience can lead to higher retention rates and increased customer satisfaction. By investing in user-friendly interfaces, responsive customer support, and efficient processes, businesses can attract and retain customers at a lower cost.

Examples of Successful Businesses

Companies like Dropbox, Airbnb, and Uber have effectively improved their CAC efficiency by implementing innovative marketing strategies, focusing on customer experience, and leveraging referral programs. These businesses have managed to acquire and retain customers while optimizing their marketing spend, showcasing the importance of CAC efficiency in sustainable growth.