Life insurance plans are like the cool kids in school, offering a variety of options to secure your future. Get ready to dive into the world of financial security and peace of mind in a way that’s totally rad.

In this guide, we’ll explore the different types of life insurance plans, the benefits they offer, important factors to consider when choosing one, and how these plans actually work in real life. So, grab your backpack and let’s get started!

Types of Life Insurance Plans

Life insurance plans come in various types, each offering different benefits and features to suit individual needs. The three main types of life insurance plans in the market are term life insurance, whole life insurance, and universal life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It is the most affordable option and offers a death benefit to beneficiaries if the insured passes away during the term. This type of plan is ideal for young families, individuals with limited budgets, or those looking for temporary coverage to protect against specific financial obligations like mortgages or children’s education.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured. It also includes a cash value component that grows over time, allowing the policyholder to access funds through loans or withdrawals. Whole life insurance offers guaranteed death benefits, stable premiums, and serves as a long-term investment vehicle. This type of plan is suitable for individuals looking for lifelong coverage, estate planning, or wealth transfer purposes.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. It combines a death benefit with a cash value component that earns interest based on market performance. Policyholders can adjust their premiums and coverage amounts over time to adapt to changing financial needs. Universal life insurance is ideal for individuals seeking a customizable policy that can provide both protection and investment opportunities.

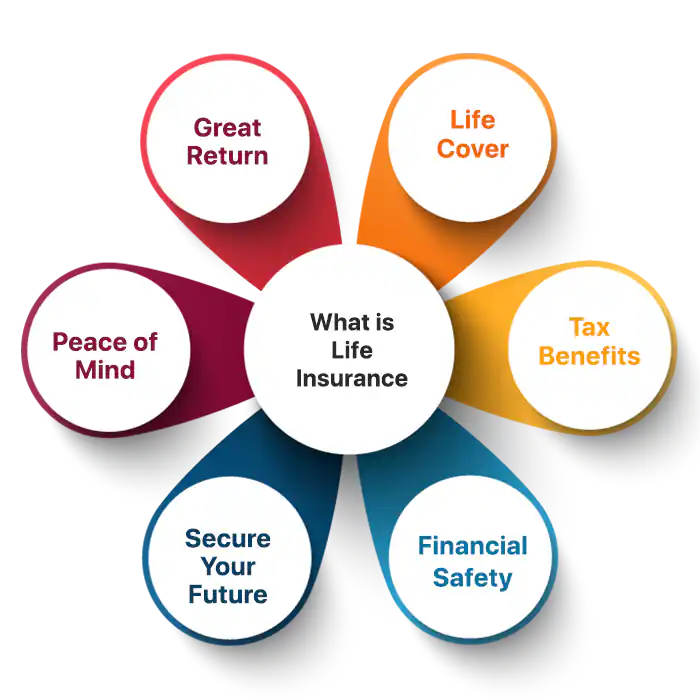

Benefits of Life Insurance Plans

Life insurance plans offer various advantages that can provide financial security to beneficiaries and positively impact families. By having a life insurance plan, individuals can ensure that their loved ones are protected in the event of their passing.

Financial Security for Beneficiaries

Life insurance plans provide a financial safety net for beneficiaries by offering a lump sum payment or regular income after the policyholder’s death. This can help cover living expenses, mortgage payments, and other financial obligations, ensuring that the family’s financial stability is maintained.

- Life insurance can help cover funeral expenses, which can be a significant financial burden for families.

- It can also help pay off outstanding debts, such as a mortgage or loans, preventing financial strain on the surviving family members.

- Life insurance can replace lost income, ensuring that beneficiaries can maintain their standard of living even after the policyholder’s death.

Positive Impact on Families

Real-life examples demonstrate how life insurance plans have positively impacted families by providing financial support during challenging times. For instance, a family who lost their primary breadwinner was able to avoid financial hardship and continue to meet their needs thanks to the life insurance payout.

Life insurance plans offer peace of mind, knowing that loved ones will be taken care of financially when you’re no longer around to provide for them.

Factors to Consider When Choosing a Life Insurance Plan

When selecting a life insurance plan, there are several key factors that individuals should take into consideration to ensure they choose the most suitable option for their needs.

- Coverage Amount:

- It is crucial to determine the right coverage amount that will adequately protect your loved ones in case of your untimely demise. Consider factors such as your outstanding debts, future financial needs of your dependents, and any other expenses that may arise.

- Premium Costs:

- Understand the premium costs associated with the life insurance plan you are considering. Compare quotes from different insurers and ensure that the premiums fit within your budget without compromising the coverage benefits.

- Policy Terms:

- Review the policy terms carefully to understand the duration of coverage, renewal options, and any exclusions or limitations that may apply. Make sure the policy aligns with your long-term financial goals and provides the necessary protection for your loved ones.

Age, Health, and Financial Goals Influence

When choosing a life insurance plan, your age, health status, and financial goals can significantly impact your decision-making process.

- Age:

- Your age plays a crucial role in determining the type of life insurance plan you should opt for. Younger individuals may benefit from lower premiums on term life insurance, while older individuals may find whole life insurance more suitable for long-term coverage.

- Health:

- Your health condition can affect the premiums you pay and the type of coverage available to you. Individuals with pre-existing medical conditions may need to explore specialized life insurance options or consider additional riders to enhance their coverage.

- Financial Goals:

- Consider your financial objectives when choosing a life insurance plan. Whether you aim to provide financial security for your family, build cash value over time, or leave a legacy for future generations, your life insurance plan should align with your overall financial plan.

How Life Insurance Plans Work

Life insurance plans operate by providing financial protection to the policyholder’s beneficiaries in the event of the policyholder’s death. When applying for a life insurance policy, the individual must choose the coverage amount and type of policy that best fits their needs. Premium payments are made either monthly, quarterly, semi-annually, or annually, depending on the chosen payment schedule.

Policy Application Process

- The application process typically involves filling out a detailed form with personal and health information.

- Underwriting may be required, which includes a medical examination or review of medical records.

- The insurance company assesses the risk and determines the premium based on the applicant’s age, health, lifestyle, and coverage amount.

Premium Payments, Life insurance plans

- Policyholders must make regular premium payments to keep the policy active.

- Failure to pay premiums can result in policy lapse or termination.

- Payment frequency can vary based on the policyholder’s preference.

Death Benefit Distribution

- When a policyholder passes away, the beneficiaries named in the policy receive the death benefit.

- The beneficiaries need to file a claim with the insurance company and provide necessary documentation, such as a death certificate.

- Once the claim is approved, the beneficiaries receive the sum assured as a lump sum or in installments, depending on the policy terms.