Crypto staking rewards open doors to a world of passive income in the blockchain realm. Let’s dive into how you can earn, optimize, and protect your staking rewards with style and finesse.

Overview of Crypto Staking Rewards

Cryptocurrency staking rewards are incentives given to users who participate in the process of validating transactions on a blockchain network. This process involves users locking up their coins as collateral to support the network’s operations and security. In return, they earn a passive income in the form of additional coins.

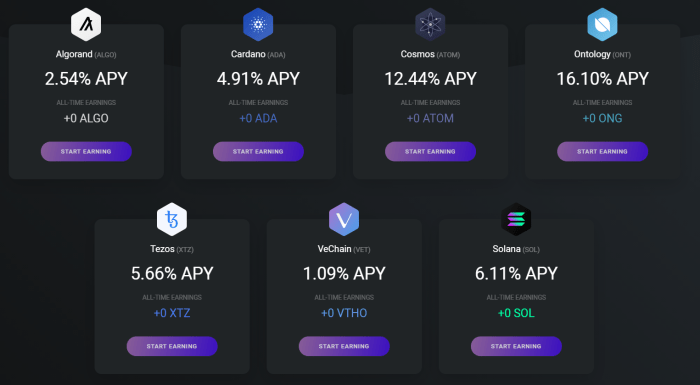

Popular cryptocurrencies that offer staking rewards include Ethereum, Cardano, Polkadot, and Tezos. These networks use a proof-of-stake (PoS) consensus mechanism, where users are selected to create new blocks and validate transactions based on the number of coins they hold and are willing to stake.

Earning staking rewards in the crypto space comes with several benefits compared to other forms of passive income. Firstly, staking rewards offer a way for users to actively participate in the maintenance and security of the network while earning rewards. Additionally, staking rewards can provide a more stable and predictable income stream compared to trading or holding cryptocurrencies, which are subject to market volatility.

How to Earn Crypto Staking Rewards

To start earning crypto staking rewards, you first need to stake your cryptocurrencies. Staking involves holding a certain amount of a specific cryptocurrency in a digital wallet to support the operations of a blockchain network. In return for staking your coins, you receive rewards in the form of additional coins.

Difference Between Proof-of-Stake (PoS) and Other Consensus Mechanisms

When it comes to staking rewards, the main difference lies in the consensus mechanism used by the blockchain network. Proof-of-Stake (PoS) is a popular consensus mechanism where validators are chosen to create new blocks and validate transactions based on the number of coins they hold and are willing to “stake” as collateral. In contrast, other consensus mechanisms like Proof-of-Work (PoW) rely on miners solving complex mathematical puzzles to validate transactions and create new blocks.

- Proof-of-Stake (PoS): Validators are selected to create new blocks based on the amount of cryptocurrency they hold and are willing to stake.

- Proof-of-Work (PoW): Miners compete to solve complex mathematical puzzles to validate transactions and create new blocks.

Staking rewards are typically higher in PoS systems compared to PoW, as PoS requires less computational power and energy consumption.

Strategies for Maximizing Staking Rewards and Minimizing Risks

To maximize your staking rewards while minimizing risks, consider the following strategies:

- Choose a reputable and secure staking platform or wallet to stake your cryptocurrencies.

- Diversify your staking portfolio to reduce the impact of volatility in any single cryptocurrency.

- Stay informed about the projects you are staking with, including their roadmap, team, and community support.

- Regularly monitor your staking rewards and adjust your strategy as needed based on market conditions.

Factors Influencing Staking Rewards

When it comes to earning staking rewards in the crypto world, there are several key factors that can influence the amount of rewards a participant can earn. Factors such as token price, staking duration, network participation, validators, and delegators play a crucial role in determining the rewards one can receive.

Token Price

The price of the token being staked is a significant factor in determining staking rewards. A higher token price means higher rewards in terms of fiat currency. Participants can earn more rewards when the token price goes up, increasing the value of their staked tokens.

Staking Duration

Staking duration is another important factor that influences rewards. Generally, the longer you stake your tokens, the more rewards you can earn. Some staking platforms offer higher rewards for longer staking periods as an incentive for participants to lock their tokens for an extended period.

Network Participation

The level of network participation also impacts staking rewards. Higher network participation can lead to lower rewards for individual participants due to increased competition. Conversely, lower network participation can result in higher rewards for stakers as there are fewer participants to share the rewards with.

Validators and Delegators, Crypto staking rewards

Validators and delegators play a crucial role in the staking ecosystem and can impact rewards. Validators validate transactions and secure the network, earning rewards in return. Delegators, on the other hand, delegate their tokens to validators and earn a share of the rewards generated by the validator. The performance and reliability of validators can affect the rewards earned by delegators.

Risks Associated with Crypto Staking Rewards

Cryptocurrency staking rewards come with their own set of risks that participants need to be aware of in order to protect their investments and maximize their returns. Let’s dive into some of the key risks associated with staking rewards.

Slashing Penalties for Malicious Behavior

When participating in crypto staking, there is a risk of facing slashing penalties for engaging in malicious behavior on the network. This includes actions such as double-signing blocks or attempting to manipulate the system for personal gain. Slashing penalties can result in a portion of the staker’s funds being forfeited as a punishment for violating the rules of the network.

Security Risks in Staking

Another significant risk in crypto staking is the security threats that stakers may encounter. Staking involves locking up a certain amount of cryptocurrency as collateral, which could potentially be at risk of theft or hacking. Participants need to take proactive measures to secure their assets, such as using hardware wallets, choosing reputable staking platforms, and implementing strong security practices to safeguard their funds.

Comparison to Other Investment Options

When weighing the risks of crypto staking rewards, it’s essential to compare them to other investment options in the crypto market. While staking offers the potential for passive income through rewards, it also carries risks that may not be present in other forms of investment, such as price volatility, regulatory uncertainties, and technological vulnerabilities. Investors should carefully consider these factors before diving into staking to ensure they are making informed decisions about their financial future.